How to link Pancard with Aadhar card Online?

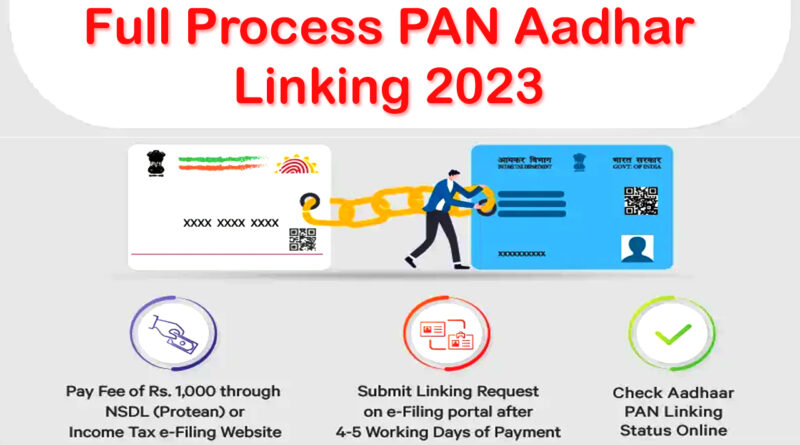

I can provide you with general guidance on how to link your PAN card with your Aadhaar card online. Please note that the process may vary depending on the specific website or portal provided by the Income Tax Department of India. Here are the general steps you can follow:

- Visit the official website of the Income Tax Department of India: Start by visiting the official website of the Income Tax Department at https://www.incometaxindiaefiling.gov.in/. Ensure that you are on the correct and official website to avoid any scams or fraudulent activities.

- Locate the PAN-Aadhaar Linking section: Look for the section or tab related to PAN-Aadhaar linking on the website. It may be labeled as “Link Aadhaar” or “Link PAN with Aadhaar” or something similar. Click on that section to proceed.

- Enter your PAN and Aadhaar details: In this step, you will be required to enter your PAN card number, Aadhaar number, and other requested details. Double-check the information you provide to ensure accuracy.

- Verify your details: After entering the necessary details, the website may provide an option to verify the information you have entered. Review the details carefully and ensure they match your PAN and Aadhaar records. If everything is correct, proceed to the next step.

- Complete the linking process: Once you have verified your details, you may be asked to provide additional information or complete any required fields. Follow the instructions provided on the website to complete the PAN-Aadhaar linking process.

- Generate OTP or use Aadhaar-based e-Sign: Depending on the portal or website, you may need to generate an OTP (One-Time Password) that will be sent to the mobile number registered with your Aadhaar. Alternatively, you may have the option to use Aadhaar-based e-Sign to authenticate the linking process.

- Submit the request: After completing the necessary steps, submit your request to link your PAN card with your Aadhaar card. The website should provide a confirmation or acknowledgment of your request.

- Check status: You may be able to check the status of your PAN-Aadhaar linking request on the website. This will allow you to ensure that the linking process has been successfully completed.

It’s important to note that the exact process and steps may change over time, so it’s always a good idea to refer to the official Income Tax Department website or contact their helpline for the most up-to-date and accurate information.

How to changes on PAN card details?

if you want to make changes to your PAN card details, you can follow these general steps:

- Visit the official NSDL PAN website: Go to the official website of NSDL (National Securities Depository Limited) for PAN services. The website is https://www.onlineservices.nsdl.com/paam/.

- Select the “Changes or Correction in PAN Data” option: On the NSDL PAN website, look for the “Changes or Correction in PAN Data” section and click on it. This option is typically available under the “Application Type” dropdown menu.

- Fill out the PAN change application form: You will be redirected to a form where you need to fill in your personal information and the changes you want to make to your PAN card. Provide accurate information and ensure that you have supporting documents for the changes you wish to make (such as proof of address, proof of identity, etc.).

- Submit the form and make payment: After filling in the required information, submit the form. You will be prompted to make a payment for the PAN card correction process. The fee for making changes to PAN card details may vary, so check the current fee structure on the website.

- Print and sign the acknowledgment: Once you have made the payment, an acknowledgment with a unique 15-digit acknowledgment number will be generated. Print the acknowledgment form and sign it.

- Attach supporting documents and send the application: Along with the signed acknowledgment form, attach copies of the required supporting documents as mentioned on the website. Ensure that you have self-attested these documents. Send the application and documents to the address mentioned on the website within 15 days of submitting the online application.

- Track the status of your application: You can track the status of your PAN card correction application online by using the acknowledgment number generated during the application process. This will allow you to check if your application has been processed and if any additional information is required.

It’s important to note that the specific steps and procedures may change over time, so it’s always a good idea to refer to the official NSDL PAN website or contact their helpline for the most up-to-date and accurate information on how to change your PAN card details.